If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

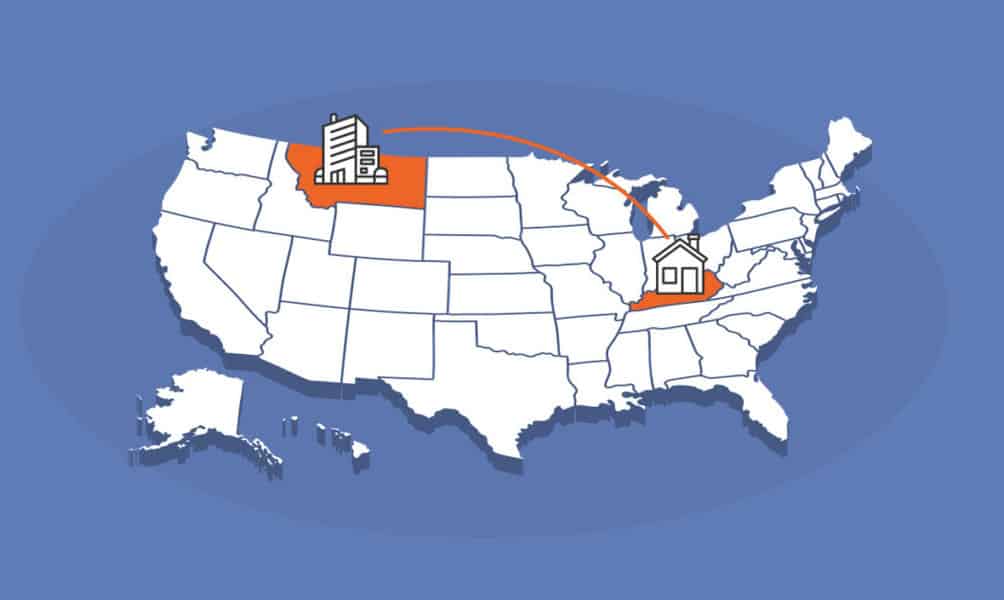

Can You Live in One State and Own a Business in Another?

Written by: Martin Eckler

Martin Eckler is the in-house legal advisor for and a commercial attorney with over 20 years of experience in commercial law and business strategy.

Published on July 20, 2021

Do some digging into the owners of industry and you will find the vast majority do not live in the state where they own their businesses. It’s perfectly legal to live in one state and own a business in another. In fact, doing so might even be financially prudent.

Plenty of business owners, for instance, establish their primary residence in the sunny state of Florida to minimize property tax and income tax, yet still own businesses in other states, many of which also have minimal taxes.

Let’s take a closer look at the dynamics of owning a business while living in a different state.

What Does “Doing Business in Another State” Really Mean?

Merely having a single client in another state or selling a product or service to clients in a state different from your own does not automatically mean your business is actually operating in the state in question. Each state has idiosyncratic requirements in terms of what constitutes conducting business.

In general, operating a business in a state means having a bank account in the state, having an office or facility in the state, owning property in the state, holding meetings in the state or selling within the state through a party linked to your business, such as a sales rep or distributor.

If your business does any of the activities listed above in a state outside of where you live, it is time to reexamine whether you are in full compliance with the laws of that state. A strict adherence to the letter of the law has the potential to prevent potentially significant punitive fines and additional penalties.

How to Qualify to Conduct Business in Another State

You cannot simply set up shop in another state and start conducting business right away. Rather, you must qualify to conduct business in another state.

Businesses that engage in intra-state business that qualifies as not incidental to the company are required to qualify to conduct business within the state where operations will occur.

Each state has its own unique guidelines for businesses in the context of legally conducting operations. However, all states require that the owner of the company complete paperwork, pay fees, designate a registered agent for accepting documents such as potential lawsuits, and possibly even publish a notice in the local paper.

Of course, these are all surmountable barriers to conducting business in another state and shouldn’t cause you to lose a second of sleep.

Taxation for Conducting Business in a Different State

Note that qualifying to conduct business in another state is only one piece of the puzzle for long-term entrepreneurial success. Conducting business in a state in which the business owner does not live triggers tax responsibilities in that state.

In order to remain in business in the new state, the appropriate business taxes must be paid. Corporations pay the state corporate income tax on profits earned within the state’s borders.

LLC members can bypass taxation to an extent by seeking a tax credit from the resident state. Furthermore, the business is also required to fulfill the new state’s requirements for employment taxes and also pay sales tax on the sale and shipment of tangible property to locations within the state.

It’s best to be in full compliance with the law and tax obligations, as the last thing you want is a tax audit.

Mind Those Bureaucratic Requirements or Pay the Price

If you want to conduct business in a different state from where you live and fail to register your company in the new state, you will eventually be penalized.

The penalty for failing to register your business in another state could be a significant fee, with more added each day, or a flat fee until the money owed is paid in full. In addition, most states can dismiss or delay legal actions filed by unqualified businesses through a closed-door statute.

If the court delays the legal action, it might also mandate the business qualify to operate in the state and also provide payment for a late penalty fee prior to moving forward.

Is Owning a Business in Another State Really Worth It?

Now that you know that living in one state while owning a business in another state is wholly legal, it’s time to shift your attention to whether doing so is financially prudent. Indeed, it often makes financial sense to own a business in a state where you do not live.

Owning a business in a different state can reduce the company’s tax burden as plenty of states have significantly lower business tax rates than others. Furthermore, there are significant differences in the business laws of each state.

Some states have business-friendly laws while others have laws and tax rules that prove quite burdensome to businesses. This is precisely why so many businesses incorporate in the tax-friendly state of Delaware.

In fact, some companies looking for financing outside of their business might find certain investors demand incorporation in the state of Delaware prior to moving forward with their investment in the enterprise.

Delaware is certainly a small state that draws little media attention, but its corporate laws are advantageous and executives tend to heap praise on the state’s Court of Chancery.

It also makes sense to own a business in a state different from where the owner lives for a litany of reasons. Some business owners prefer owning the company in a state such as Wyoming, New Mexico or Nevada, where the amount of business information collected and publicized is kept to a bare minimum.

Of course, some business owners do not mind their personal information being on the public record, so this benefit holds little appeal for them.

Be Strategic When Launching Your Business

The moral of the story is that you should sweat the small stuff when it comes to incorporating your business, because owning a business in a state different from your home state might save you a great deal of money.

Now that you know it’s possible to own a company in a state in which you do not live, it’s time to make your dream of starting your own business come true.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

10 Best LLC Formation Services

Published on August 22, 2022

Read Now

How to Transfer an LLC to Another State

Published on November 16, 2021

If you have a limited liability company (LLC), you might wish to transfer your LLC to a new statebecause: You’re moving and want to take your ...

Read Now

How to Change a Business Address For an LLC

Published on November 10, 2021

Even if you have an online business and you sell all over the country or even the world, your business still needs a physical address. Without there ...

Read Now

Comments