If your business sells physical products or certain types of services, you will need to collect and pay sales tax. In Alabama, the first step isvisi ...

How to Register for a Sales Tax License in Alabama

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on July 4, 2022

If you have recently launched or are planning to launch a business that will sell products or services in Alabama, you may be wondering how to get a sales tax license. It’s a relatively simple process, as detailed in this step-by-step guide.

In Alabama, the Sales Tax License is also commonly referred to as the Alabama Sales Tax Permit, Resale Certificate or Alabama Sales Tax Registration. This permit is mandatory for businesses that sell, lease, or rent tangible personal property, and those providing certain services.

What is a Sales Tax License?

If your business has a valid sales tax license, you can buy goods from a wholesaler without paying Alabama sales tax, though you may pay a use tax. Depending on the size of your business, this can save you tens of thousands of dollars each year. In Alabama, you just need to present your sales tax license to the seller of the goods to avoid paying sales tax.

The catch is that whenever you do use your sales tax license to purchase goods, you are legally bound to resell those items and collect sales tax when you do so. If you do not resell those items, or fail to collect sales tax, the punishment could be that you will be liable for the sales tax on those goods.

Keep in mind, each sales tax license, also known as a resale license, applies to a single vendor. Thus, you’ll need a sales tax license for each one of your vendors. In Alabama, this means that you’ll need to present a copy of your sales tax license to each of your vendors.

You cannot use your sales tax license to buy items you do not intend to resell, such as a new computer for your business. This would be tax fraud, a felony offense. You are only able to buy items tax-exempt if you are going to collect sales tax on them later.

Not all wholesalers will accept your Alabama sales tax license, nor do they have to. They may choose not to because of the risk of expired or false certificates or licenses, which would put the wholesaler on the hook for the sales tax.

How to Apply for a Sales Tax License in Alabama

In a few states, including Alabama, a seller’s permit, or sales tax license, also serves as a resale certificate that applies to all vendors.

The Department of Revenue issues sales tax licenses in Alabama. You simply need to fill out the application on the department’s website.

The seller’s permit identifies you with your state as a collector of sales tax. If you sell tangible personal property or goods you are required to have a sales tax permit. In some states, even a service provider like a lawyer is required to have a sales tax permit and collect state sales tax.

The sales tax license applies to items that you buy for resale, or for parts that you buy to manufacture something for sale.

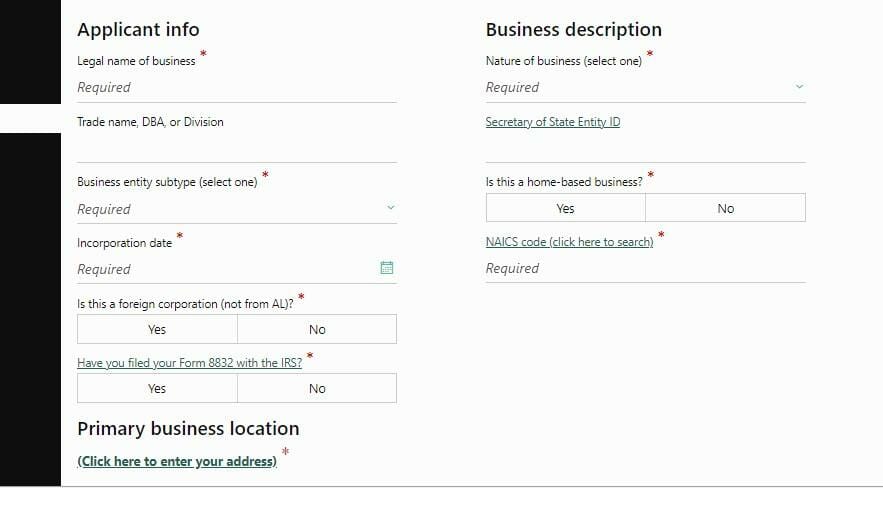

How to Fill out the Alabama Sales Tax License Application

In Alabama, the Department of Revenue issues sales tax licenses. Start by visiting the website, then follow these simple steps:

- Enter your entity type and FEIN

- Select sales tax for the type of tax you’re applying for.

- Fill out all the requested information about your business.

The whole process may take half an hour, as you’ll be asked for detailed information about the products or services you sell. There is no fee for the application, and you should receive your sales tax license within 10 days.

Does an Alabama Sales Tax License Expire?

In Alabama, sales tax licenses expire after one year. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

Conclusion

Sales tax licenses can be a bit of a hassle, but in Alabama, they are an absolute necessity. So take the time to get copies of your sales tax license for each of your vendors to ensure full compliance with your state’s tax regulations.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

Alabama Sales Tax Calculator

Published on May 3, 2022

Read Now

How to Start an LLC in Alabama in 7 Steps

Published on March 16, 2022

Here are the steps you need to take to start a limited liability company (LLC) inAlabama: Choose a name for your Alabama LLC: Your businessname ...

Read Now

Starting a Business in Alabama: 13-Step Guide

Published on August 19, 2021

Alabama may be part of the Deep South, but it has a roaring economy and a strong job market, making it a great place for entrepreneurs. Ifyou’ ...

Read Now

Comments