If your business sells physical products or certain types of services, you will need to collect and pay sales tax. In New Mexico, the first step isv ...

How to Get a Non-Taxable Transaction Certificate in New Mexico

Written by: Natalie Fell

Natalie is a business writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on July 7, 2022

If you have recently launched or are planning to launch a business that will sell products or services in New Mexico, you may want to get a non-taxable transaction certificate, or several of them, before you start doing business, as this can save you a lot of time and money.

This document is known as a resale certificate in most other states, and attaining one is a relatively simple process, as detailed in this step-by-step guide.

What is a Non-Taxable Transaction Certificate?

If your business has a valid non-taxable transaction certificate, you can buy goods from a wholesaler without paying New Mexico sales tax, though you may pay a use tax. Depending on the size of your business, this can save you tens of thousands of dollars each year.

The catch is that whenever you do use a non-taxable transaction certificate to purchase goods, you are legally bound to resell those items and collect sales tax when you do so. If you do not resell those items, or fail to collect sales tax, the punishment could be costly fines or potential jail time.

Keep in mind, each non-taxable transaction certificate, also known as a resale license, applies to a single vendor. This means you’ll need a non-taxable transaction certificate for each one of your vendors.

You cannot use a non-taxable transaction certificate to buy items you do not intend to resell, such as a new computer for your business. This would be tax fraud, a felony offense. You are only able to buy items tax-exempt if you are going to collect sales tax on them later.

Not all wholesalers will accept non-taxable transaction certificates, nor do they have to. They may choose not to because of the risk of expired or false certificates, which would put the wholesaler on the hook for the sales tax.

How to Apply for a Non-Taxable Transaction Certificate in New Mexico

In New Mexico, you’ll need to obtain the form from the Taxation & Revenue Department. The certificate is not filed with the state of New Mexico, it’s simply kept on file by the seller.

In a few states, a seller’s permit, or sales tax permit, also serves as a non-taxable transaction certificate that applies to all vendors. But in most states, including New Mexico, you’ll need a seller’s permit as well as non-taxable transaction certificates for each of your vendors.

The seller’s permit identifies you with your state as a collector of sales tax. If you sell tangible personal property or goods you are required to have a sales tax permit. In some states, even a service provider like a lawyer is required to have a sales tax permit and collect state sales tax.

The non-taxable transaction certificate applies to items that you buy for resale, or for parts that you buy to manufacture something for sale.

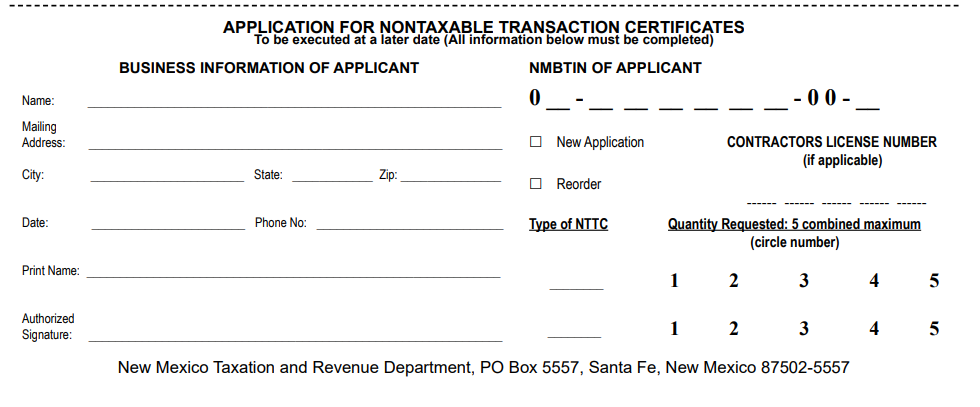

How to Fill out the New Mexico Non-Taxable Transaction Certificate

In New Mexico, the Taxation & Revenue Department handles the issuance of non-taxable transaction certificates. Start by visiting the website, then follow these simple steps:

- On the Forms and Publications page, search for form ACD-31050 and download the form.

- At the bottom of the form, fill in your vendor’s information.

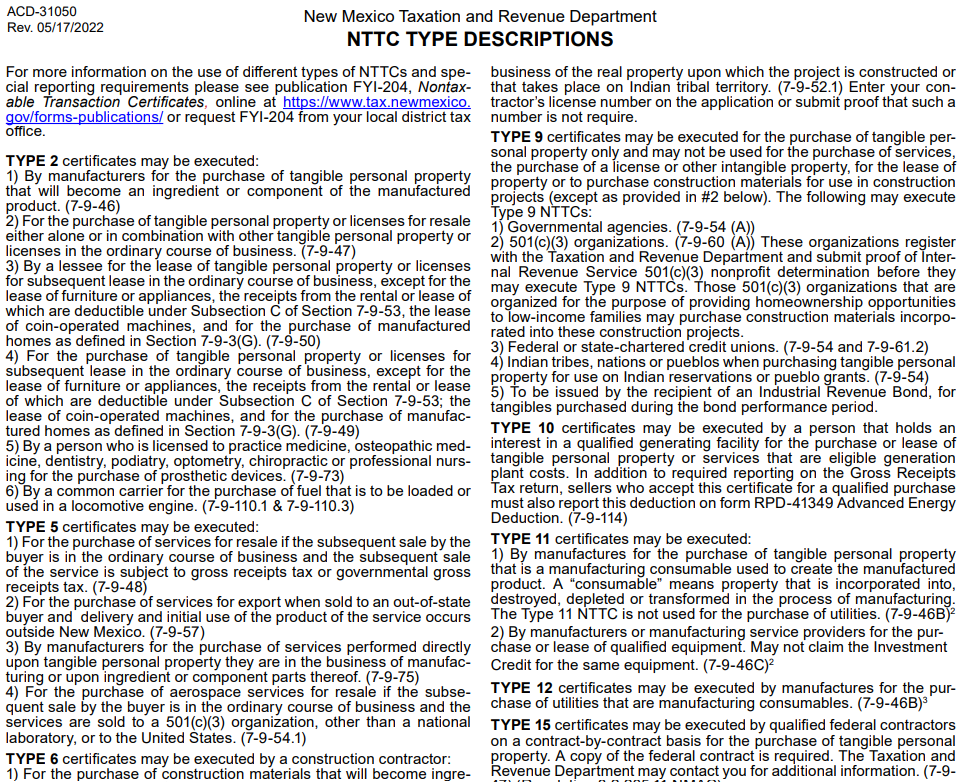

- Under Types of NTTC, refer to the second page of the form titled Type Descriptions and fill in the appropriate code.

- Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the New Mexico Taxation & Revenue Department at 1-866-285-2996.

Does a New Mexico Non-Taxable Transaction Certificate Expire?

In New Mexico, non-taxable transaction certificates do not expire.

Conclusion

Non-taxable transaction certificates can be a bit of a hassle, but in New Mexico they are an absolute necessity. So take the time to get certificates for each of your vendors to ensure full compliance with your state’s tax regulations.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

New Mexico Sales Tax Calculator

Published on April 16, 2022

Read Now

How to Start an LLC in New Mexico in 7 Steps

Published on March 16, 2022

Here are the steps you need to take to start a limited liability company (LLC) in NewMexico: Choose a name for your New Mexico LLC: Yourbusines ...

Read Now

Starting a Business in New Mexico: 13-Step Guide

Published on November 11, 2021

If you live in New Mexico, or dream of moving there, you probably know that it’s a beautiful state with a rich culture and history. You may not be ...

Read Now

Comments