Here are the steps you need to take to start a limited liability company (LLC) inAlaska: Choose a name for your Alaska LLC: Your business namem ...

Alaska’s economic development website offers a wealth of business resources.

We earn commissions if you shop through the links below. Read more

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on August 19, 2021

Alaska may have a small economy and be the coldest of all US states, but it’s warm and welcoming to a wide variety of businesses. As the pandemic recedes, opportunities abound in sectors related to tourism, outdoor activities, and natural resources.

If you’re considering starting a business in Alaska, you’ll need to plan ahead, do your research, and ensure you have everything you need to make it successful. Thankfully, you’ve come to the right place, as this step-by-step guide provides all the information you need to launch a successful business in The Last Frontier.

By 2022 revenue((https://www.ibisworld.com/united-states/economic-profiles/alaska/))

The crucial first question is, what sort of business would you like to run? You may have several ideas in your head, or maybe you haven’t gotten that far. Either way, it’s wise to look closely at the state itself and at your own abilities to best determine which areas might offer the most opportunity.

To develop a business idea, you could:

Once you have a few ideas in mind, do some homework to decide if your ideas are feasible. Here are some things to consider when choosing a business idea:

First, consider the viability of the business idea you have in mind. Here are three questions to consider:

Starting a business requires investment, so it’s unwise to just assume profitability. Make it a point to conduct research and ask people you know and trust what they think of your idea.

Alaska’s economic development website offers a wealth of business resources.

The next thing to do is define your offerings. Ask yourself:

You may consider offering related products or services to increase purchase sizes and boost overall value for customers. This step is going to define how your business will look to customers and why they will buy, so take your time and be sure.

Before determining your price list, get to know your competitors. Visit the shops and websites of companies that offer similar products or services — see what they’re selling and at what prices and use this to inform your decisions.

If you have a direct competitor, it’s a good idea to choose a competitive price point. Run the numbers to find your break-even price, then use this Step By Step profit margin calculator to determine your mark-up and final price point.

You’ll also need to consider how to position your product. Are you going to offer a lower-priced alternative, a la Walmart, or are you going to position your business as more high-end, like a Pottery Barn or Restoration Hardware?

Once you’ve locked on a pricing system that works for you, you’ll need to test it to see if this is attractive to your target market.

Knowing your target market is crucial to successful sales and marketing. This is where customer profiling comes in handy.

The first thing to do is figure out whether you’re selling to consumers or businesses. If you choose consumers, determine which people are most likely to buy, by looking at:

Knowing your customers will allow you to shape your messaging and know where to place your marketing. For example, based on who your customers are and what they like, are they more likely to be on Facebook or TikTok?

If you are selling to businesses, first determine what kinds of firms will be interested in what you’re offering. Next, figure out the relevant decision-maker within these companies — it may be a VP, IT manager, or head of sales — and adjust your marketing accordingly.

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember.

Here are some ideas for brainstorming your business name:

Once you have a few potential names, check Alaska’s Corporations Database to see if the name is available to register. The state also provides information on how to determine if a business name is “distinguishable.” Finally, you should confirm that the name you want to register conforms to Alaska’s business license name requirements.

It’s also a good idea to check for nationally trademarked names, to ward off any potential problems later if your business expands, and check the availability of related domain names using Domain Name Checker tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Once you’re sure that the name is all yours and meets the regulations, go ahead and register. Here’s information on reserving or registering a business name in Alaska. It costs $25 to reserve or register a name and can be done online or by mail.

Drawing up a business plan may seem like a daunting task, but it’s an essential step in creating a successful business. The plan will function as a trail map to guide your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision.

If you’ve never created a business plan yourself before, it can be an intimidating task. Consider hiring an experienced business plan writer to create a professional business plan for you.

Choosing your business location is an important decision because it can affect your taxes, legal requirements, and revenue. But you’ve already decided to launch your business in Alaska, so we can check that box.

But you might want to review the state’s guidance on how to get licensed.

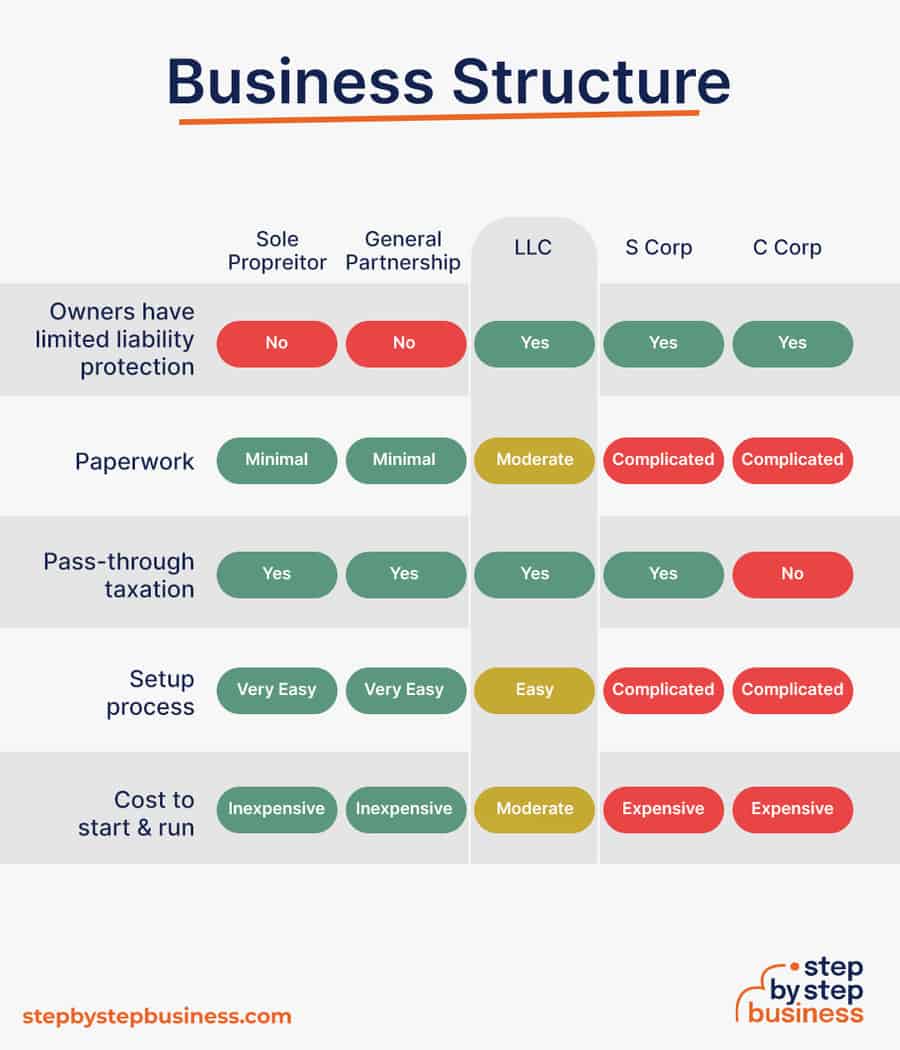

Businesses come in several varieties, each with its pros and cons. The legal structure you choose for your business shapes your taxes, personal liability, and business registration requirements, so it’s important to choose wisely.

The most popular business entity types are outlined below.

Sole proprietorship is the most simple and straightforward structure, and therefore the most common for small businesses. It is an unincorporated business, with no legal distinction made between the business and the owner. As a sole proprietor, all income goes to you, but you are also liable for any debts, losses, or liabilities incurred by the business.

General partnership is similar to sole proprietorship, but with two or more people forming the company. Again, they keep the pre-tax profits but are jointly liable for any losses or liabilities. In a general partnership, each partner is known as a general partner and has unlimited liability.

The next step up is a corporation, in which the company is a separate legal entity from its owners. In this structure, the owners are not personally liable for losses, but take their profits through shareholder dividends.

If you choose to create an Alaska corporation, you’ll also need to decide whether you want to form a C corporation or an S corporation. Here are some resources on forms and fees for Alaska corporations, as well as statutes and regulations.

A limited liability company (LLC) combines characteristics of corporations with those of sole proprietorships. As the name suggests, the owners are not personally responsible for liabilities or debts. As an LLC, you’ll need to choose whether you want to be taxed as an LLC or as an S Corp.

The regulations for LLCs vary from state to state. Although they are more straightforward to set up than a corporation, Articles of Organization must be filed with the state for the LLC to become a legal entity.

You will also need to appoint an Alaska registered agent, also known as an agent for service of process. Your registered agent will be responsible for receiving paperwork from the state.

Information and resources for forming an LLC in Alaska are available in the professional licensing section of the state’s website.

An easy and quick way to form an LLC is to use ZenBusiness’s online LLC formation service.

Finally, you may be interested in a nonprofit if your business idea has a social purpose. A non-profit organization is a legal entity organized and operated for a public or social benefit, as opposed to a business formed to generate a profit for its owners.

You will also need to appoint a registered agent, also known as an agent for the service of the process. Your Alaska registered agent will be responsible for receiving all of the official paperwork sent from the state.

Resources are available in the non-profit FAQ section of Alaska’s state website.

The final step before you’re able to pay taxes is getting an Alaska Employer Identification Number or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business operations will occur over the period of a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

After creating your business plan, you should know how much money you’ll need to launch your business. Securing financing is your next step and there are plenty of ways to raise capital:

You may need to obtain certain business licenses and permits to comply with Alaska law. These can vary based on the town or city where your business is located. If you’re selling tangible goods in Alaska, you’ll need a seller’s permit.

Your city, town, or county may also have additional requirements, such as signage and zoning permits. Speak to representatives of your local governments about licensing requirements. Alaska has specific licenses and permits for fishing, food, lodgings, and other sectors, so it’s important to check if your industry has specific licenses or permits. Here are some resources:

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes. You might consider a license compliance package from a filing firm such as MyCorporation or MyCompanyWorks, or hire an attorney via Avvo or FindLaw.

More resources:

Before you launch your business you’ll need somewhere to put the money you make, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you run your business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer business account options, just inquire at your preferred bank to learn about rates and features.

Banks vary in terms of offerings, so it’s a good idea to consider your options to choose the best plan that works for you. Once you choose your bank, you’ll need to bring your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and any other legal documentation that proves your business is registered.

Business insurance is an area that often gets overlooked yet it can be vital to your success. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some of the different types of insurance to consider:

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

New businesses need to have the right tools and industry-specific software in place to help them manage their operations effectively.

One of the most important tools for a new business is an inventory management system, which allows them to track their inventory levels, monitor sales, and reorder products when necessary.

Another essential tool is a customer relationship management (CRM) system, which helps businesses manage their interactions with customers and prospects, and track sales leads.

Other useful software for new businesses might include payroll software, project management tools, and marketing automation software. By investing in the right tools and software, new businesses can streamline their operations, save time and money, and ultimately increase their chances of success.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Online marketing is crucial for new businesses as it provides a cost-effective way to reach a wider audience and build brand awareness. With a well-planned online marketing strategy, new businesses can establish their presence, attract potential customers, and compete with established players in their industry.

Here are some powerful digital marketing strategies for small businesses:

Take advantage of your website, social media presence and real-life activities to increase awareness of your offerings and build your brand.

Traditional marketing is any form of marketing that uses offline media to reach an audience. Some options include:

As your business grows, you will likely need workers to fill various roles and positions. But before you begin the hiring process, you should first consider the essential positions for your line of work.

What levels of management and employees will you have? What is your pay scale? Costs are always an issue for a startup, but you need to make sure that you pay enough to hire people with the right skills and experience.

It’s a good idea to create a hiring plan. First, determine which hires you’ll need to launch, then the future hires you’ll need as the business gets going. Be cautious and selective when hiring people for any role.

You want to build a great team that will make your business run smoothly and create a great work environment so you’ll retain them for a long time.

In Alaska, there are a few steps you will need to complete, including registering new employees, setting up payroll taxes, and following all employer-employee regulations. More information is available at the Alaska Small Business Development Center.

Free-of-charge methods to recruit employees include publishing a job ad on LinkedIn, Facebook or Jobs.com. You might also use a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Finally, you could hire a recruitment agency to help you find talent.

With everything in place, you’re now ready to throw open the doors on opening day! When you do, you’ll want some customers coming in. Here’s how to find them.

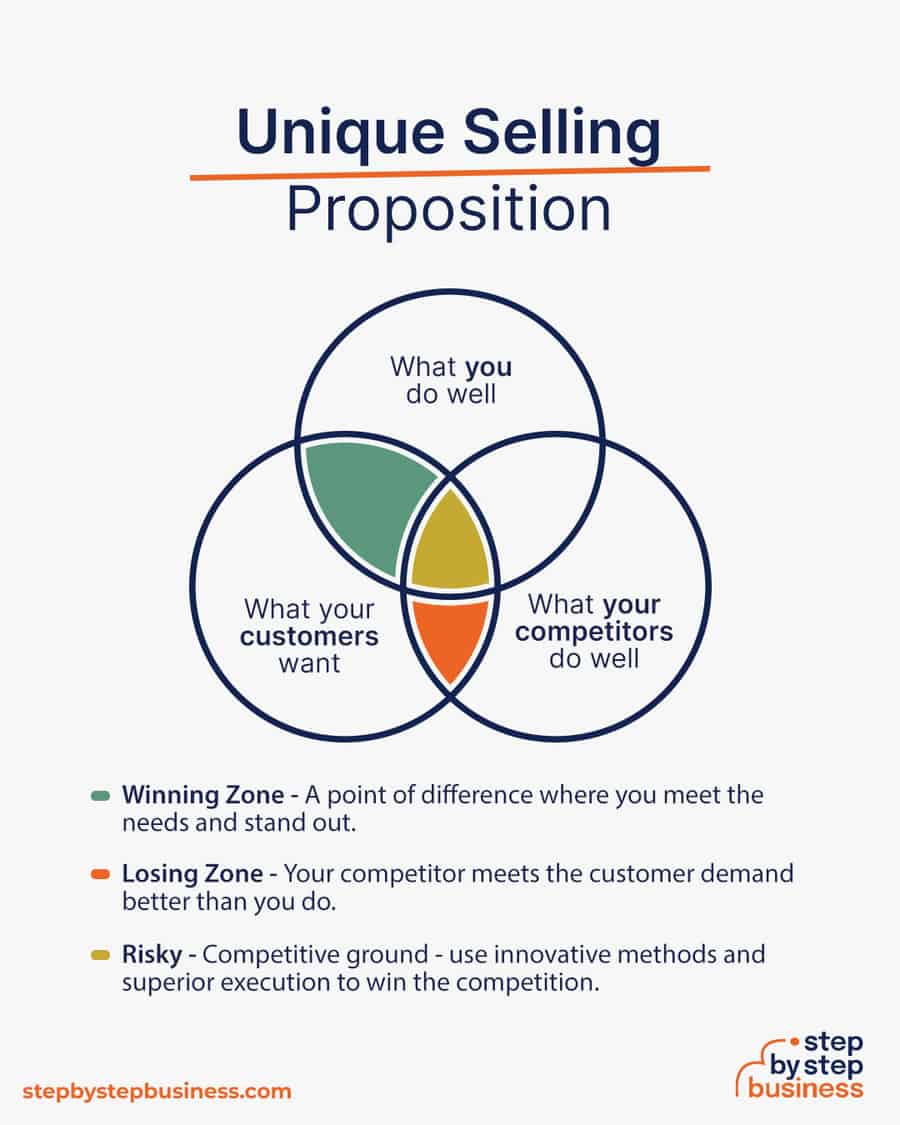

Make sure to highlight the unique selling propositions, or USPs, of your products and services. Customers may already want your offerings, so your job is to convince them to pick you over your competitors.

Here are some good selling points that you can capitalize on:

Make sure that you are selling through the right channels. You know your target customers by now – where and how are they most likely to buy? Do they buy online or in stores?

If you don’t have a store, you can find partner stores where your products can be sold. You can sell both online and directly but focus your efforts on the channel that matches your target market’s buying behavior.

If you’re selling to businesses, your sales channels may be online or they may involve direct sales calls. Again, understand the buying behavior of the decision-maker within the business.

Help clients find you more easily by placing your marketing where they are likely to find it. With the right marketing strategies in place, a business can reach new audiences, build brand awareness, and ultimately grow its customer base and revenue.

Effective marketing can help businesses differentiate themselves from competitors, establish a strong online presence, and engage with customers through various channels such as social media, email marketing, and advertising.

By investing in the right marketing tactics and continually analyzing and optimizing their efforts, businesses can position themselves for long-term growth and success.

You’re now ready to start doing big business in Alaska, but you might want to bookmark this page, just in case.

The cost for a business license in Alaska is $50/year, which includes the entire year or part of the initial year if you start part way through. There is a discount for senior citizens over the age of 65 and disabled veterans who are starting sole proprietorships. The cost for them is $25/year.

More information on obtaining a business license is available on the State of Alaska Commerce website’s FAQ section.

The answer to this question is “it depends.” For some people, Alaska is the perfect place to start a business! However, others will not like the Alaska lifestyle, with a colder climate, fewer people, and poorly connected to the rest of the United States.

One thing to consider is the cost of running a business. Because it is so far from the contiguous US, transportation and shipping costs are very high. That being said, business taxes are very low, helping entrepreneurs in Alaska save some money and reinvest it back into your business.

For Alaska to be a good place to start a business, an entrepreneur must be interested in living and working in a remote state like Alaska. They also need to carefully choose the industry to ensure it is in demand.

Because choosing a profitable industry is a key to success for an entrepreneur, a lot of people will wonder what the best business is to start in Alaska. Some of the best opportunities are around the natural resource industries such as oil, gas, and petroleum.

The tourism and travel industry also offers excellent business opportunities. Alaska sees a large influx of tourists, particularly through the cruise ship industry.

Finally, the transportation and haulage industry is another lucrative industry in Alaska. Since the state is so far removed from the rest of the United States, shipping logistics is a big business that costs a lot of money, presenting opportunities for entrepreneurs.

This article has covered all the main steps to set up a company in Alaska and start your business, but here is the overview of all the steps:

Published on March 16, 2022

Here are the steps you need to take to start a limited liability company (LLC) inAlaska: Choose a name for your Alaska LLC: Your business namem ...

Read Now

Published on September 26, 2021

Starting a business can be stressful, even overwhelming. The last thing you need is one more issue to think about, but you really should take thetim ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments